At the highest level, when looking at a Payment Method, it is important to understand certain key characteristics.

In this Glossary, we are focussed on Open Systems which will inevitably be structured as a Network with one or more Hubs (Switches).

Closed System

A Closed System is exactly how it sounds - a system in which a User can only transact with someone else who also has an account at the same Financial Institution (FI).

There are huge benefits to Closed Systems:

- Easy to Secure: Being a Closed system, there are few external access points, making it far easier to secure against a breach than an Open system with many high volume access points.

- Smaller Target: A single system is a relatively small target compared to being part of a massive network.

- Control Full Transaction: As a transaction is fully retained within the FI system, the FI would have a record of the full transaction, whereas with a network the FI would only have a record of their part of the transaction. This means, when there is any kind of fraud, it can generally be easily researched, and also easily reversed as the funds would have remained within the FI system.

- Fast, Inexpensive Transactions: As a transaction is fully contained within the Fi system, transfers are little more than a simple internal accounting transfer. This means they are both instant and inexpensive for the FI to accomplish, and therefore can be inexpensive for the Users.

- Tiny Transactions: Because transactions are so inexpensive to process, it is viable for the FI to facilitate transfers as small as 5¢-10¢.

- Free Account: As the cost of security as well as transaction processing is extremely small in comparison to an Open System, there is no reason for the FI to charge for the account.

The Downside:

- Reach: You can only transact easily with someone else who also has an account at the same FI.

- Funds In/Out: It is generally difficult getting cash into or out of an account, or funds transferred from/to an account elsewhere. The whole purpose of a Closed system is to not do these types of transactions. There is likely to be a fee on these, and also likely to take time to complete.

- Limited Use: A User can only use their funds in a manner offered by the FI, using services offered by the FI, with those approved by the FI.

- Tied to the FI: Due to the difficulty of transferring funds out of the FI, your funds in the FI are effectively tied to the FI.

Open System

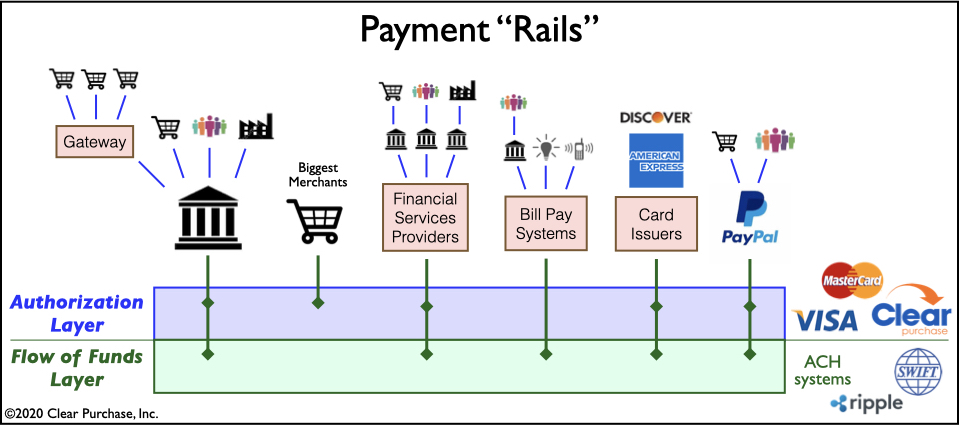

This is when multiple financial systems connect to each other to transact between them.

While this often starts with direct connections between those financial systems, it invariably results in a Network with Hubs, allowing each system to only manage a single connection to the Hub while the Hub connects all other systems together. As the Network grows, there will likely end up being multiple Hubs connected to each other.

There are huge benefits of Networks:

- Reach: You can now transact with everyone else, regardless of where they have an account. For the biggest Networks, this means you can transact with anyone else anywhere in your country, or even worldwide.

- Multiple FI Accounts: You can now easily move money around to other accounts you may have at other FIs.

- Range of Services: You will have access to anyone and anything on the entire Network, and all the services they offer. In addition, as it is easy to move money to other accounts elsewhere, you will have access to different services those FIs offer.

The Downside:

- Cost: Interoperability is expensive to configure, manage and secure.

- Security: A Network is a far bigger target than a single Closed System. A breach anywhere in the Network might put your system and your Account Holders at risk. See Payment Fraud section below.

These Hubs, in the Payment World, are called a Payment Switch, a Settlement Switch or a combination of them both.

Interoperability

This is the term used for one financial system communicating with another financial system to transact between them.

Basically, a Closed System becoming an Open System.

This is a newer word in the industry, however it excellently describes its meaning.

Pull Vs Push Payment Methods

Pull payment method:

A receiver of funds “Pulls” funds from the sender’s account.

Examples: Credit/Debit Cards, ATM Cards, Checks, Bill Payments, Apple Pay, PayPal, Western Union (credit/debit cards), and ACH Systems.

Push payment method:

A sender of funds “Pushes” funds from his/her account to the receiver

Examples: Wires, Swift, Western Union (cash deposits), Cryptocurrencies, Mobile Wallets & Mobile Money, and obviously Physical Cash.

Important: A Pull Payment Method is far more vulnerable to fraud than a Push Payment Method. See Payment Fraud section below.

If a payment method can facilitate both Push and Pull transactions, then it is classified as being the more dangerous Pull method. For example, ACH Systems where most transactions are Push, however there can be (at least in the USA) some Pull transactions.

From a technology standpoint, ask yourself this question:

Is there ever a time when my system will receive a request message from another system, whereby my system is expected to withdraw funds from my customer’s account and send it to the other company?If Yes, then it is a "Pull" method.

Front End Applications

In this Glossary we are focussed primarily on the Back End Infrastructure/Platform of the payment industry.

However, User Access to payment services and the User Experience are equally important.

- In a Branch of a Financial Institution with an Employee.

- Using an ATM.

- Using a Point of Sale (POS) device at a Merchant.

- Directly with a Financial Institution Representative (outside a Branch).

- Online through a Website.

- Using a Cell Phone via Text Messaging.

- Using a Smartphone with a Mobile App.

The Smartphone

The Smartphone has the most potential of broadening financial services directly to the User in an easy to use interface.

Marc Andreessen recognized the Smartphone as a technology revolution of global proportions: "The smartphone revolution is under-hyped, more people have access to phones than access to running water. We’ve never had anything like this before since the beginning of the planet".

Services Available

When looking at any Financial Institution and/or Payment Method, consider the Services available to Users.

- Send of Funds.

- Payroll.

- Bill Pay: Single / Automatic / Recurring / Variable.

- Bill Presentment.

- Purchase: Real-Time / Pre-Auth / Reversal.

- Purchase Guarantee & Dispute Resolution.

- Currency Exchange.

- Building Credit & Access to Loans.

- Merchant Underwriting.

- Retirement and other Savings Tools.

- Brokerage, Tax Preparation, and other Financial Services.