A Payment Switch

Clear Purchase is building a Payment Switch connecting Financial Institutions together, like a hub in a wheel, in order to facilitate transactions between their account holders. This is often called Interoperability.

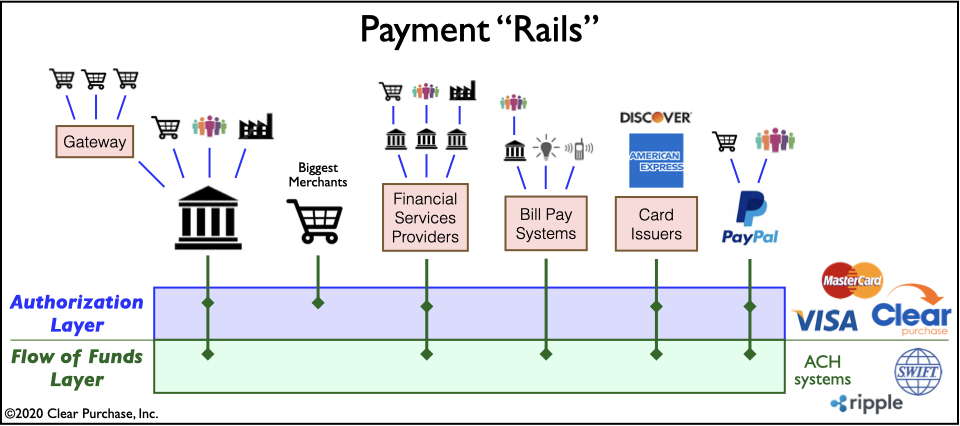

Payment Rails

Clear Purchase is part of the Authorization Layer of the Payment Rails.

Clear Purchase facilitates the transaction Authorizations, and utilizes the existing financial infrastructure (the Flow of Funds Layer) for the actual sending of funds.